Ultra Low Cost Canadian airline, Flair Airlines, has had four of their aircraft repossessed in a sudden and unexpected commercial dispute which has been pinned down to not paying lessors on time.

On March 11th 2023, lessor Airborne Capital Ltd repossessed four aircraft placed at Flair Airlines after they alleged Flair owed the company $1 million in unpaid leases.

In commercial aviation, $1 million is not typically enough to warrant such drastic action, as repossessing aircraft is a labour intensive and large-scale job for lessors to undertake. This led people to wonder if there was more to the story than Flair was playing off.

It didn’t take long for Flair Airlines CEO Stephen Jones to effectively state that the repossessions were a result of other carriers attempting to weaken the airline for their own benefit. Jones added that the airline was now caught up with the payments owed to Airborne Capital Ltd.

“We think that the seizure of these aircrafts was connected to conversations with another airline”

Stephen Jones, CEO Flair Airlines, during a press conference regarding the matters.

Unfortunately for Flair, things did not improve from there. Airborne states that Flair was behind up to five months in leases and had failed to meet their contractual obligations. Multiple notices were sent to Flair regarding the defaults, however the issues were not resolved and the lessor took the final option of repossessing their assets.

The following list contains the four repossessed aircraft as well as the three that have had their Canadian registrations cancelled, indicating that they will not be re-joining the Flair fleet anytime soon.

- C-FFLA (737-800) seized at Toronto Pearson International (YYZ), registration cancelled 13/03/2023

- C-FLKD (737 MAX 8) seized at Waterloo International (YKF), registration cancelled 13/03/2023

- C-FLKI (737 MAX 8) seized at Edmonton International Airport (YEG), registration cancelled 13/03/2023

- C-FLRS (737 MAX 8) seized at Toronto Pearson International (YYZ), registration still active

The four aircraft remain inactive as the dispute becomes more and more public between the lessor and Flair Airlines.

Canada’s Air Passenger Protection Regulation requires passengers to be compensated by the airline for the disruption. Compensation for an airline of Flair’s size and for the seizure of aircraft could be up to $500 per passenger, leading to further financial woes if publicity about the repossessions escalate.

Mass cancellations of tickets can be a result of such news, and it isn’t made any better that the repossessions have already lead to around 1900 passengers having their flights cancelled, with 420 of them having to wait up to three days to rebook. This is extremely bad timing for Flair as its currently March break where people are most likely to book flights.

Despite this, Flair has remained positive on social media, re-assuring passengers that steps were being taken to maintain schedule integrity and to ensure passengers made their way to their destinations regardless if it was with Flair or any other airline.

Despite the corporate battle involving the four aircraft ongoing behind the scenes, passengers are being offered massive discounts on new bookings for a limited time.

Between March 14 and March 16, passengers can save 35% off base fares using promo code spring35. The sale includes flights to Vancouver, Halifax and Calgary as well as holiday destinations such as Cancun and Palm Springs – Perfect for the Canadian March break.

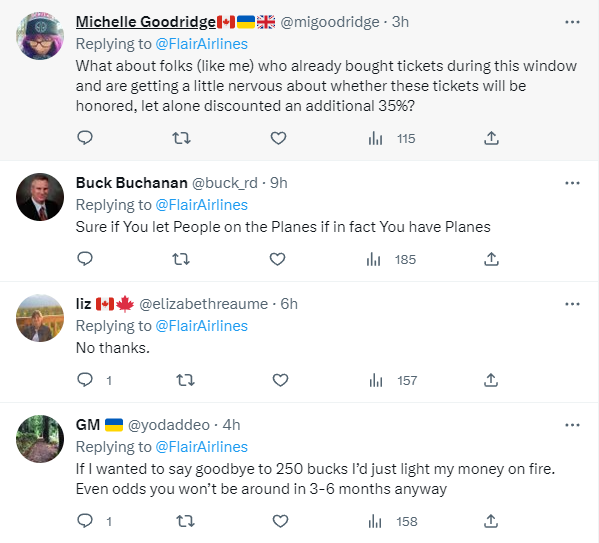

Potential takers remain reluctant after seeing the news though, with some taking to social media with concern about the airlines situation.

At this stage there has been no further comment from Flair Airlines or Airborne regarding the matter, however, there is no doubt serious conversations are being held behind the scenes to ensure the airline can continue operating and can address any operational issues it may have.

Flair’s parent company, 777 Partners, advertises the airline as the first and only “pure-play” Canadian ultra-low-cost carrier with an à la carte business model.

777 Partners also backs Bonza, a recently launched Australian budget airline centred around leisure-driven routes within the domestic market, operating the Boeing 737 MAX just like Flair.

At this stage, 777 Partners has not released any statement regarding the situation Flair is facing.

What are your thoughts on Flair Airlines’ situation? Will this effect them in the long term?