November 7th 2019, the Emirates Group announced their half-year results for the 2019-20 financial year.

For Emirates (excluding dnata):

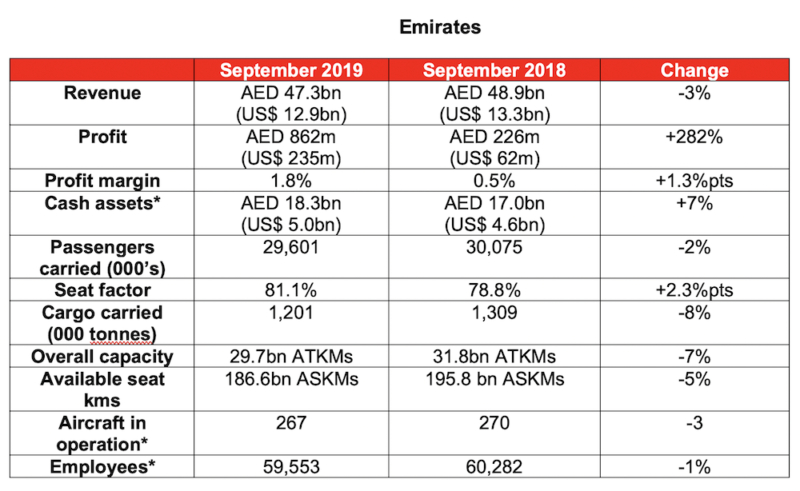

- Revenue down 3% to AED 47.3 billion (US$ 12.9 billion)

- Profit increase of 282% to AED 862 billion (US$ 235 million)

- Seat load factor of 81.1%, up 2.3% pts

- 29.6 million passengers carried

- Carrying 7.9% more customers to its hub city

Emirates explains that the slight revenue decline was mainly due to planned capacity reductions during the 45-day Southern Runway closure at Dubai International airport (DXB) and unfavourable currency movements in Europe, Australia, South Africa, India and Pakistan.

The 282% increase in net profit was driven by increased agility in capacity deployment, with healthy customer demand for Emirates’ products driving improved seat load factors and better margins.

The Emirates Group delivered a steady and positive performance in the first half of 2019-20, by adapting our strategies to navigate the tough trading conditions and social-political uncertainty in many markets around the world. Both Emirates and dnata worked hard to minimise the impact of the planned runway renovations at DXB on our business and on our customers. We also kept a tight rein on controllable costs and continued to drive efficiency improvement, while ensuring that our resources were deployed nimbly to capitalise on areas of opportunity.

The lower fuel cost was a welcome respite as we saw our fuel bill drop by AED 2.0 billion compared to the same period last year. However, unfavourable currency movements wiped off approximately AED 1.2 billion from our profits.

The global outlook is difficult to predict, but we expect the airline and travel industry to continue facing headwinds over the next six months with stiff competition adding downward pressure on margins. As a Group we remain focussed on developing our business, and we will continue to invest in new capabilities that empower our people, and enable us to offer even better products, services, and experiences for our customers.His Highness (HH) Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive, Emirates Airline and Group

During the first six months of 2019-20, Emirates received 3 Airbus A380s, with 3 more new aircraft scheduled to be delivered before the end of the 2019-20 financial year. It also retired 6 older aircraft from its fleet with a further 2 to be returned by 31st March 2020. The airline’s long-standing strategy to invest in the most advanced wide-body aircraft enables it to improve overall efficiency, minimise its emissions footprint and provide high-quality customer experiences.

Emirates continues to offer ever better connections for its customers across the globe with just one stop in Dubai. In the first six months of its financial year, Emirates added two new passenger routes: Dubai-Bangkok-Phnom Penh and Dubai-Porto (Portugal). As of 30th September, Emirates’ global network spanned 158 destinations in 84 countries. Its fleet stood at 267 aircraft including freighters.

Emirates also further developed its partnership with flydubai. Both airlines continued to leverage their complementary networks to optimize flight schedules and offer new city-pair connections through Dubai, as well as open new routes including Naples (Italy) and Tashkent (Uzbekistan) in the first half of 2019-20.

Overall capacity during the first six months of the year declined by 7% to 29.7 billion Available Tonne Kilometres (ATKM) mainly due to the DXB runway closure and reduction in the fleet during this 45-day period. Capacity measured in Available Seat Kilometres (ASKM) shrunk by 5%, whilst passenger traffic carried measured in Revenue Passenger Kilometres (RPKM) was down by 2%; with an average Passenger Seat Factor rising to 81.1%, compared with last year’s 78.8%.

Emirates carried 29.6 million passengers between 1st April and 30th September 2019, down 2% from the same period last year, however, passenger yield increased by 1% period-on-period. The volume of cargo uplifted at 1.2 million tonnes has decreased by 8% while the yield declined by 3%. This reflects the tough business environment for air freight in the context of global trade tensions and unrest in some key cargo markets.

Emirates operating costs shrunk by 8% against the overall capacity decrease of 7%. On average fuel costs were 13% lower compared to the same period last year, this was largely due to a decrease in oil prices (down 9% compared to the same period last year) as well as a lower fuel uplift due to reduced capacity during 45-day runway closure at DXB. Fuel remained the largest component of the airline’s cost, accounting for 32% of operating costs compared with 33% in the first six months of last year.

Emirates is definitely making a solid profit this year; especially when compared to the other two large Middle-East carriers, as Qatar lost $632 Million and Etihad lost $1.28 billion last year.