Boeing holds of on 797 decision

Boeing has elected to hold off until next year to announce whether they’ll build the 797.

Boeing Chief Executive, Dennis Muilenburg, states the company wants to ensure there is a firm business case before committing to the model.

The company insists that the model is being looked at very closely and airlines are currently being spoken to about what it may have to offer. Boeing is eyeing a 2025 entry into service so a launch next year is highly likely.

The 797, sometimes referred to as the New Middle Market aircraft (NMA) or Middle of the Market aircraft (MoM), is a proposed clean sheet design aircraft to fill the gap between the largest narrow body aircraft and 787 sized aircraft. The aircraft would be the ideal replacement for the aging 757, which seats anywhere from 220-270 passengers over a range of 5000 nautical miles.

Boeing suggests that a market for roughly 5000 aircraft fits this type of model.

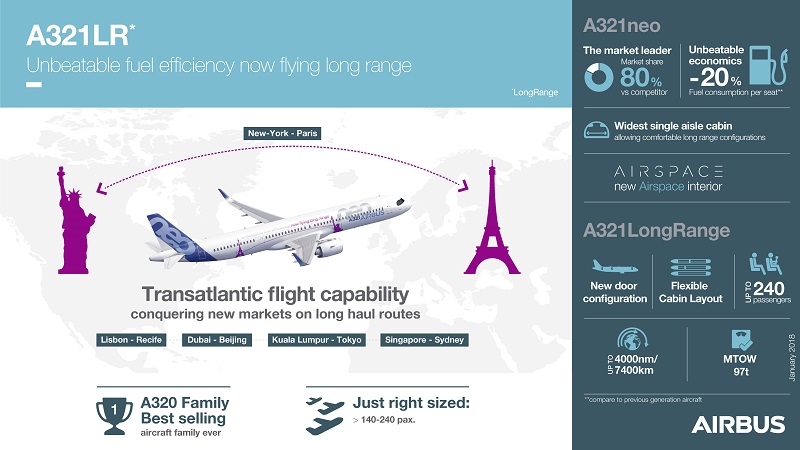

However, delays on the decision could lead to bigger problems as we’re starting to see now. Because the aircraft isn’t in the confirmation stages yet, airlines are starting to question whether it will be built. The longer airlines have to wait, the older their existing aircraft become. This leaves the market open to Airbus and their A321 LR, which isn’t an identical replacement fr the 757 but has already gained attention from leading airlines.

Boeing has stated numerous times in the past months that the aircraft would not be a groundbreaking design like the 787 if it got the go ahead. Engine manufacturers have been given a deadline to submit their offering to try and win a place on the aircraft.

Part of the business case investigation is where to build the aircraft. The location must be cost-competitive, have easy access to supplier components and feature production methods similar to aircraft already in production.

South Carolina and Washington are the two on the list that are being considered for any future aircraft manufacturing. It’s also worth noting that if the Boeing and Embraer deal goes ahead, Boeing will have access to Embraer’s facilities in Brazil, potentially unlocking future, more efficient production methods.

While Boeing’s decision to hold off isn’t necessarily a bad thing, it definitely leaves them open to their competitor who is also looking at new aircraft options and adjustments to existing frames.

One thing is very clear Mid Intercontinental Range segment is what the doctor ordered. Profit margins must be Sqeezed.. The demand is between the 757 -767 segment.. All of this is coming down to the wire….range…cost…and more important “Route flexibility”. YES the abilty to fly trans atlantic one day and the next a pacific route THIS IS A TALL ORDER! Both Boeing and Airbus is going have their noses bloodied while they Duke it out… Airlines LOVE an aiframe that can adjust to changing market conditions. Sweet spot? 230 PAX..Range…5000-6500 NM Low fuel cost ppm. This means making the aircraft lighter at lower cost with the most fuel effecient engines and selling near cost with little profit margin,,,but a huge market “EXISTS” for this bird..

Boeing is in a tough (and tight) spot here. They have already admitted NMA won’t be revolutionary, yet they will still have to incur huge investment costs to launch a new aircraft (797?) line. With the NMA space already squeezed from above (787, A350, etc.) and below (737, A320), how confident is Boeing that they are actually going to turn a profit on this new airliner?

Like the quote from the (old) Dirty Harry movie… “Do you feel lucky? Well, do ya?”

Please continue your high standards of writing by always identifying acronyms (NMA/MoM) with first use.

My apologies mate. Will add those in now.