Advertising Disclosure: Many of the links that appear on this website are from companies which SamChui.com may receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The site does not review or include all companies or all available products.

Marriott has many different credit card offerings, especially now that they work with both American Express and Chase. The one card that has been missing from the portfolio is a No Annual Fee credit card, that is until today.

Introducing the Marriott Bonvoy Bold™ Credit Card

The Marriott Bonvoy Bold™Credit Card might be the most rewarding no fee travel card on the market. Other notable no fee cards include The Bank of America® Travel Rewards Credit Card which offers 1.5 miles on all purchases or The Capital One® VentureOne® Rewards Credit Card which offers 1.25 miles on every purchase, 15 airline transfer partners, and 10x points on Hotels.com purchased stays through January 2020.

Lets take a look into the great new perks of the Marriott Bonvoy™ Bold Credit Card

Marriott Bonvoy™ Bold Credit Card – $0 Annual Fee

- 50,000 bonus points after spending 2k in first 3 months

- 3x Points at Marriott Hotels

- 2x Points on anything coded for travel

- 1x Points on everything else

- 15 Elite Night Credits (Silver Status)

- No Foreign Transaction Fees

Why I think this card is great

While cards with annual fees have better benefits, you need to put in the work in order to maximize value. For the Marriott Bonvoy™ Bold Credit Card, there is absolutely no annual fee which requires no work to maximize!

The ability to earn 2x the points on anything coded travel is huge. This is a Chase card at the end of the day and they code things like Uber + Lyft as travel among other things. Also the ability to earn Marriott Bonvoy Points is much more useful than what you earn with The Bank of America® Travel Rewards Credit Card.

What can you do with 50,000 Marriott Bonvoy Points?

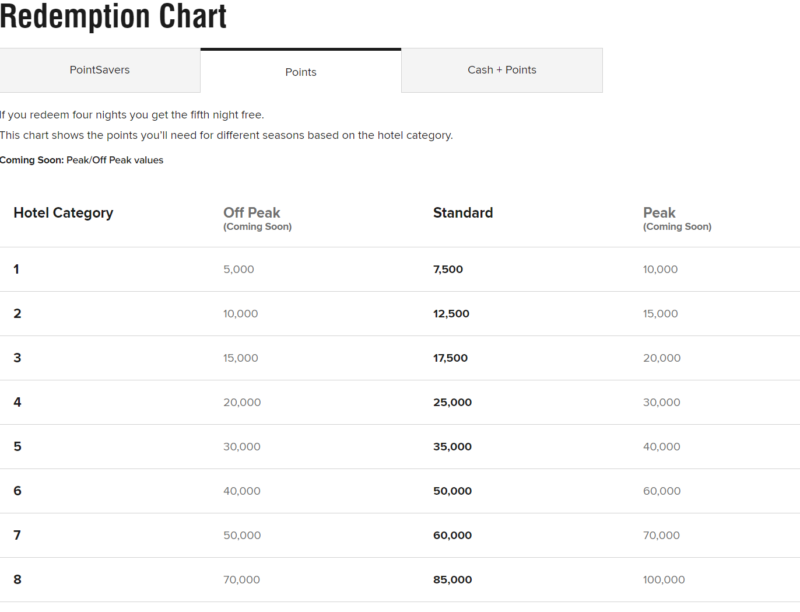

50,000 points is worth ~$350 depending on how you value points. I think they are worth about 0.7 cents each. You can see in the chart below, with 50,000 points you could get as much as 7 nights in a Category 1 hotel.

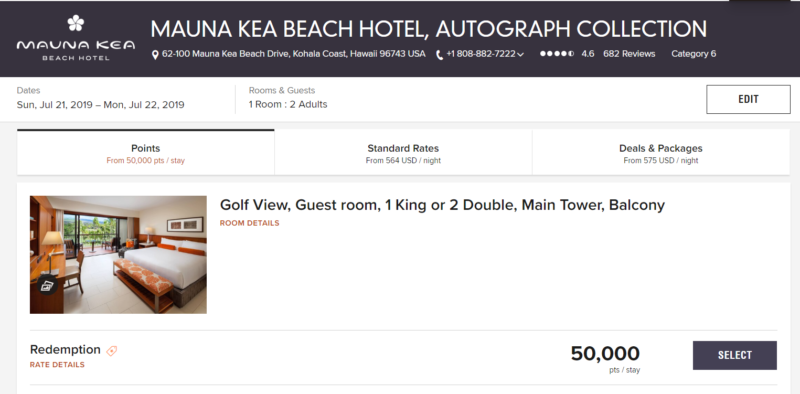

Or you could also enjoy a luxurious night at a Category 6 hotel like the Mauna Kea Beach Hotel in Hawaii, which usually retails in the high $500’s during high season.

It’s important to remember that when you use your points for 4 consecutive nights, your 5th night is free.

When you earn 60,000 points you should also consider transferring the miles to 1 of more than 40 airline transfer partners. You can check out all 40 here. It’s important to remember that for every 60,000 points transferred, you get a bonus which will translate to you getting 25,000 airlines miles. Except in the case of Air New Zealand, jetBlue and United as they have different transfer ratios.

Who is eligible for the card

As this is a Chase product, this card falls under the dreaded 5/24 rule. Meaning if you have applied for 5 cards within the last 24 months, odds are you will be automatically declined. That being said if you get targeted for this offer you may get through their system.

The product also comes with a novel as to who can earn the welcome offer and who can even apply for the card.

Eligibility for this product

The product is not available to either :

- Current cardmembers of the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless™ credit card (also known as Marriott Rewards® Premier Plus), Marriott Bonvoy Bold™ credit card, or previous cardmembers of the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless™ credit card (also known as Marriott Rewards® Premier Plus), or Marriott Bonvoy Bold™ credit card, who received a new cardmember bonus within the last 24 months.

- If you are an existing Marriott Rewards Premier or Marriott Bonvoy™ Premier customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change.

Eligibility for the new cardmember bonus:

The bonus is not available to you if you:

- Are a current cardmember

- Were a previous cardmember within the last 30 days, of Marriott Bonvoy™ American Express® Card (also known as The Starwood Preferred Guest® Credit Card from American Express);

- Current or previous cardmember of either Marriott Bonvoy Business™ American Express® Card (also known as The Starwood Preferred Guest® Business Credit Card from American Express) or Marriott Bonvoy Brilliant™ American Express® Card (also known as the Starwood Preferred Guest® American Express Luxury Card), and received a new cardmember bonus or upgrade bonus in the last 24 months;

- Applied and were approved for Marriott Bonvoy Business™ American Express® Card (also known as The Starwood Preferred Guest® Business Credit Card from American Express), or Marriott Bonvoy Brilliant™ American Express® Card (also known as the Starwood Preferred Guest® American Express Luxury Card) within the last 90 days.

The Springhill Suites Zion National Park – Category 6 Property

In Summary

If you are eligible for the card and if you have been looking for a no fee card, look no further, seriously. If you are okay paying an annual fee and putting in a little bit of work to maximize the value of your benefits, you might want to do that instead.

Feature Image Walt Disney World Swan and Dolphin Resort – Category 6 Property

Editorial Note: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Comment Disclaimer: The responses in each article are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.