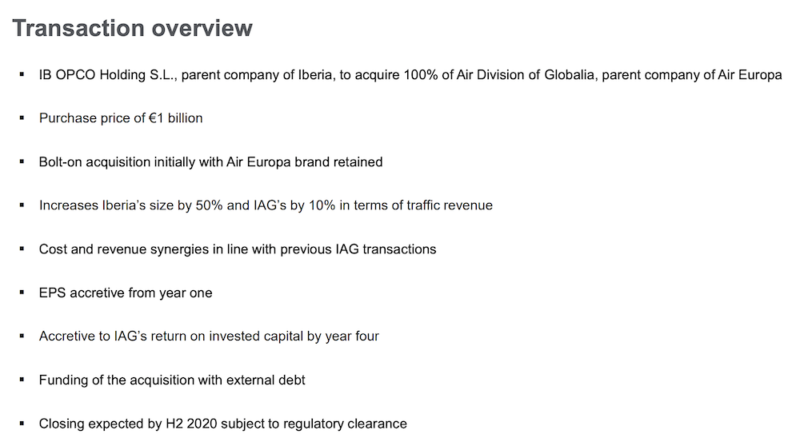

According to a press release earlier today, International Consolidated Airlines Group (“IAG”) and Globalia (“Globalia”) announced that definitive transaction agreements have been signed under which IAG’s wholly-owned subsidiary, IB OPCO Holding S.L. (“Iberia”), has agreed to acquire the entire issued share capital of Air Europa (“Air Europa”) for €1 billion to be satisfied in cash at Completion (the “Acquisition”) and subject to a closing accounts adjustment.

Highlights

While there will be many impacts coming to Air Europa, below are some of the larger ones given by IAG:

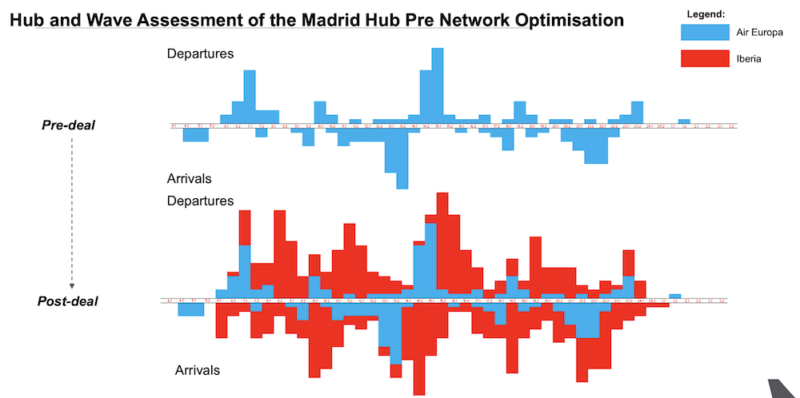

- Transforms IAG’s Madrid hub into a true rival to Europe’s four largest hubs: Amsterdam, Frankfurt, London Heathrow, and Paris Charles De Gaulle.

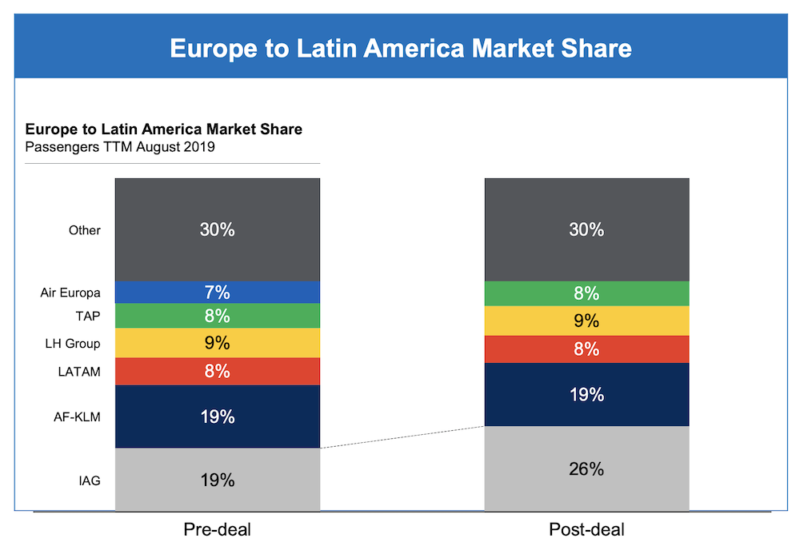

- Re-establishes IAG as a leader in the highly attractive Europe to Latin America and Caribbean market.

- Offers significant synergy potential in terms of cost and revenue.

- Completion is expected to take place in H2 2020 following receipt of relevant approvals.

Executives of IAG, Globalia and Iberia expressed their opinions about the acquisition as below:

Acquiring Air Europa would add a new competitive, cost effective airline to IAG, consolidating Madrid as a leading European hub and resulting in IAG achieving South Atlantic leadership, therefore generating additional financial value for our shareholders. IAG has a strong track record of successful acquisitions, most recently with the acquisition of Aer Lingus in 2015 and we are convinced Air Europa presents a strong strategic fit for the group.

Willie Walsh, Chief Executive of IAG

For Globalia, the incorporation of Air Europa to IAG implies the strengthening of the company’s present and future that will maintain the path followed by Air Europa in the last years. We are convinced that the incorporation of Air Europa to a group such as IAG, who over all these years has demonstrated its support to the development of airlines within the group and the Madrid hub, will be a success.

Javier Hidalgo, Chief Executive of Globalia

This is of strategic importance for the Madrid hub, which in recent years has lagged behind other European hubs. Following this agreement, Madrid will be able to compete with other European hubs on equal terms with a better position on Europe to Latin America routes and the possibility to become a gateway between Asia and Latin America.

Luis Gallego, Chief Executive of Iberia

Strategic Rationale

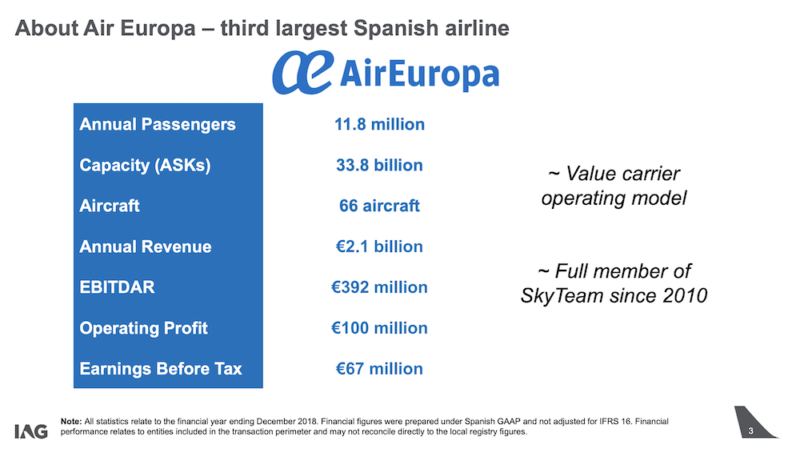

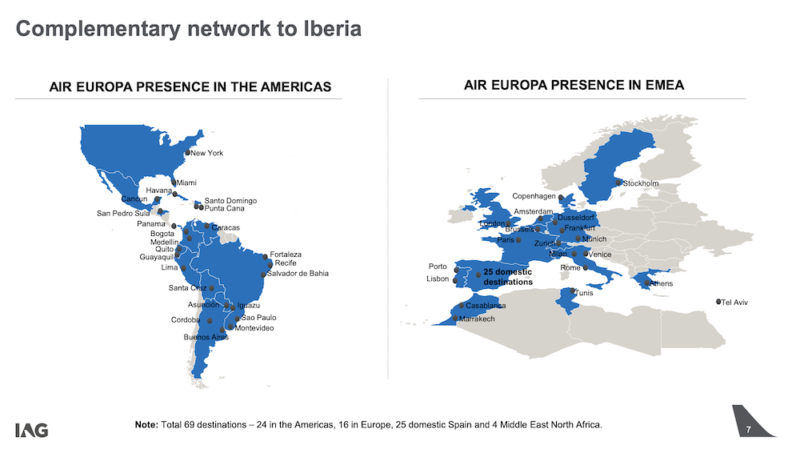

Air Europa is currently the third-largest Spanish airline, behind Iberia and Vueling; who are already owned by IAG. They operate scheduled domestic and international flights to 69 destinations, including European and long-haul routes to Latin America, the United States of America, the Caribbean and North Africa. In 2018, Air Europa generated revenue of €2.1 billion and an operating profit of €100 million. They carried 11.8 million passengers in 2018 and ended the year with a fleet of 66 aircraft.

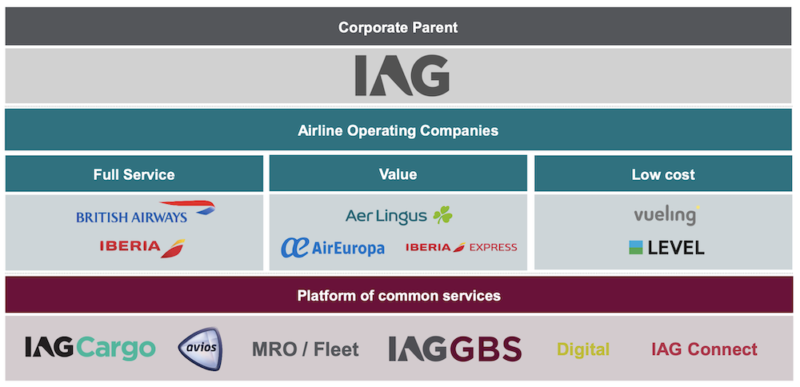

The Air Europa brand will initially be retained and the company will remain as a standalone profit center within Iberia, run by Iberia CEO Luis Gallego. The management of IAG and Iberia plan to do the following in a few years:

- Integrating Air Europa into the existing Iberia hub structure at Madrid.

- Creating commercial links between Air Europa and other IAG operating companies, in addition to inclusion into IAG’s joint businesses.

- Integrating Air Europa onto the IAG platform of common services.

What do you think about this acquisition?