The economic shock caused by Coronavirus (COVID-19) is expected to hit airlines hardest in the second quarter, which is when we could see a number of carriers begin to fold.

That is the warning from the International Air Transport Association (IATA), which has worsened its industry forecast for 2020, saying that airlines will lose $314 billion in revenues and half of their passengers this year.

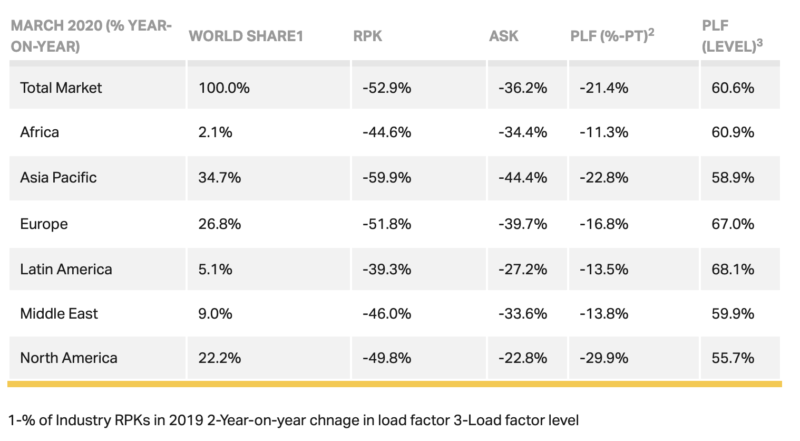

“March was a disastrous month for aviation. Airlines progressively felt the growing impact of the Coronavirus (COVID-19) related border closings and restrictions on mobility, including in domestic markets. Demand was at the same level it was in 2006 but we have the fleets and employees for double that. Worse, we know that the situation deteriorated even more in April and most signs point to a slow recovery.” said Alexandre de Juniac, IATA’s Director General and CEO.

The impact will start to bite hardest in Q2, where carriers are expected to burn though $61 billion of cash reserves.

If global travel restrictions persist, the IATA warns, many airlines that are already facing a liquidity crisis could face collapse.

“The industry’s outlook grows darker by the day. Airlines could burn through $61 billion of cash reserves in the second quarter alone. That puts at risk 25 million jobs dependent on aviation. And without urgent relief, many airlines will not survive to lead the economic recovery.”

Alexandre de Juniac, IATA’s Director General

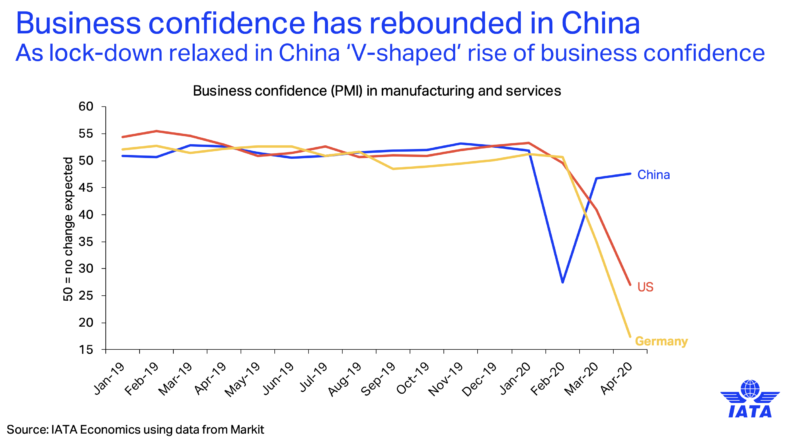

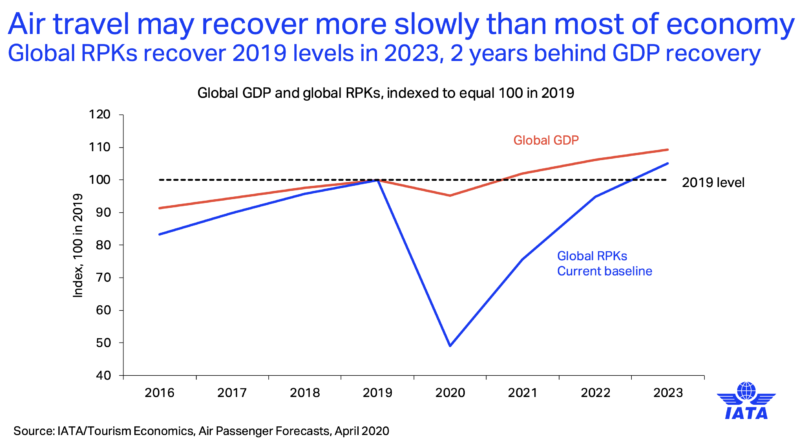

The economic shock of the Coronavirus (COVID-19) crisis is expected to be at its most severe in Q2, when GDP is expected to shrink by 6%. Passenger demand closely follows GDP; the impact of reduced economic activity in Q2 alone would result in an 8% fall in passenger demand in the third quarter, the IATA said.

The IATA warned that the most severe impact from travel restrictions will be in Q2. As of early April, the number of flights globally was down 80% compared to 2019; in large part owing to severe travel restrictions imposed by governments, to fight the spread of the virus.

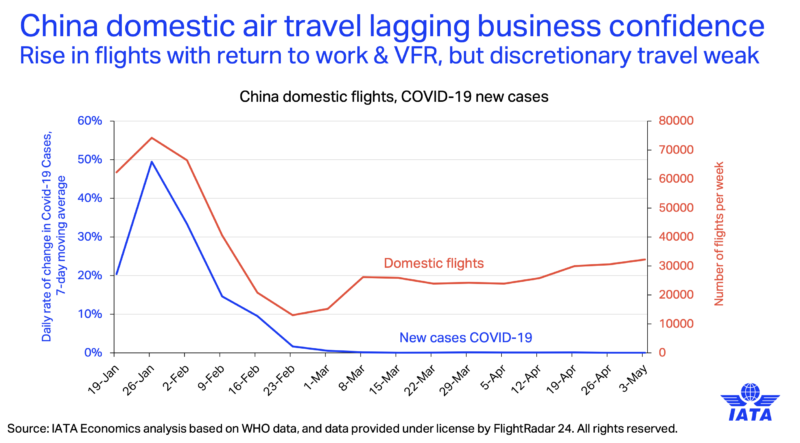

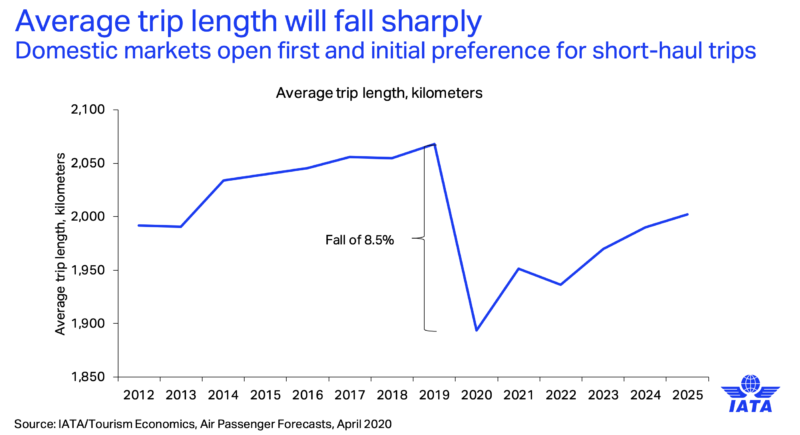

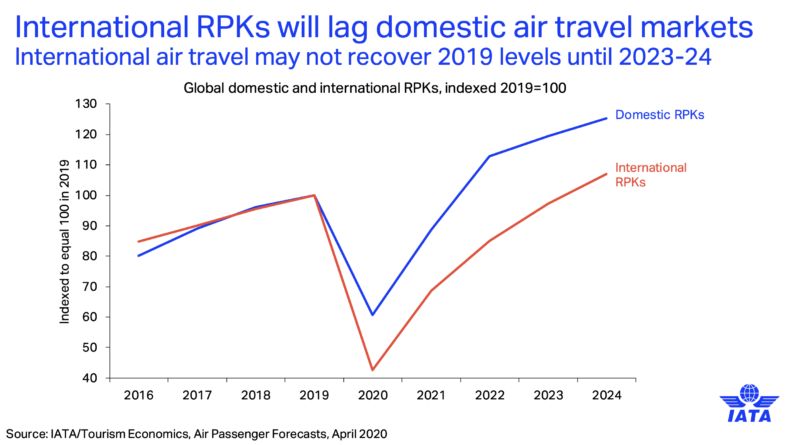

Domestic markets could still see the start of an upturn in demand beginning in the third quarter, in a first stage of lifting travel restrictions. International markets, however, will be slower to resume as it appears likely that governments will retain these travel restrictions longer, the IATA said in a statement.

The IATA’s latest assessment is based on a scenario, where the current severe travel restrictions imposed by governments last for three months. International travel cannot re-start under such conditions. In a recent IATA survey across 11 markets,

- 84% of travellers said that quarantine measures was one of their top concerns

- 69% essentially said that they would not return to travel under such conditions

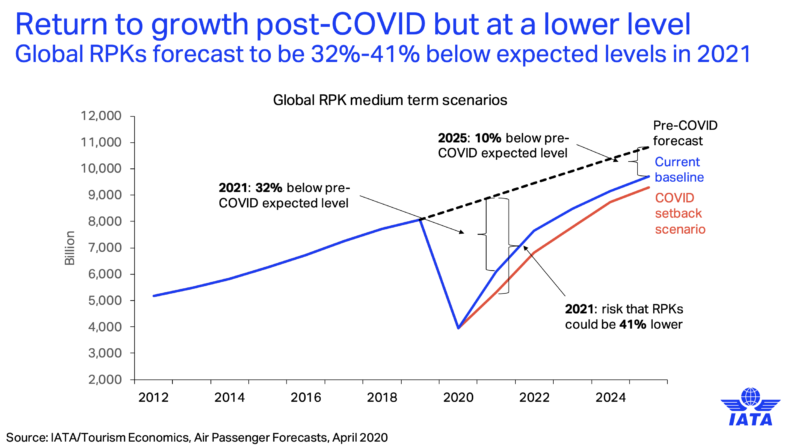

“The scale of the crisis makes a sharp V-shaped recovery unlikely. Realistically, it will be a U-shaped recovery with domestic travel coming back faster than the international market. We could see more than half of passenger revenues disappear."

“That would be a $314 billion hit. Several governments have stepped up with new or expanded financial relief measures, but the situation remains critical.” Dr Juniac said.

The IATA has once again called for financial aid and stabilisation packages from governments.

De Juniac added: “Financial relief for airlines today should be a critical policy measure for governments. Supporting airlines will keep vital supply chains working through the crisis. Every airline job saved will keep 24 more people employed."

“And it will give airlines a fighting chance of being viable businesses that are ready to lead the recovery, by connecting economies when the pandemic is contained. If airlines are not ready, the economic pain of Coronavirus (COVID-19) will be unnecessarily prolonged.”

Article Source and Slides from IATA