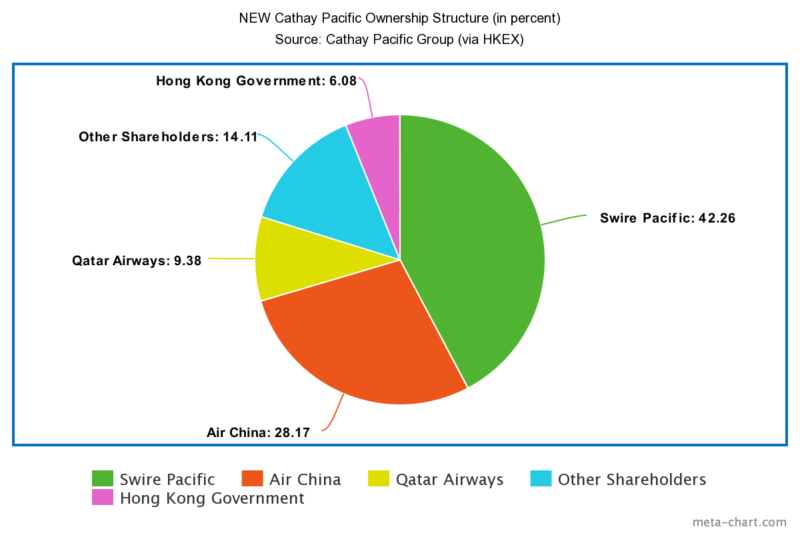

The Hong Kong Government will take a 6% stake in Cathay Pacific; equipping the airline with a combined total of approximately HK$31 billion ($4 billion) in shares and a loan. The move comes as part of the flag carrier’s HK$39 billion ($5.03 billion) recapitalisation process.

In a proposal submitted to the Hong Kong Stock Exchange, the airline detailed plans to re-evaluate “all aspects of the Cathay Pacific Group’s business model”.

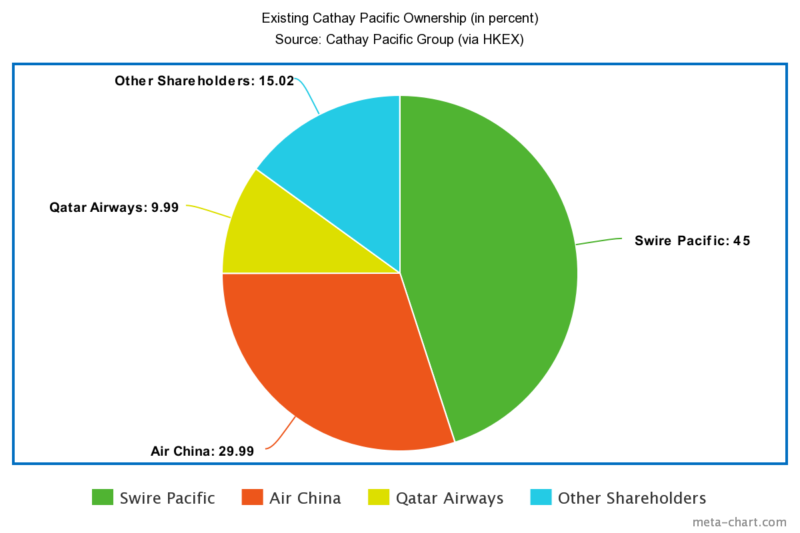

As part of the recapitalisation process, the respective ownerships of Swire Pacific, Air China and Qatar Airways will all be reduced in order for the government to take its 6.08% share. Prior to taking ownership, the Hong Kong Government will create a new commercial entity called Aviation 2020 Limited.

Hong Kong Government Contribution

By taking a stake of ownership the Hong Kong Government will ensure that Cathay Pacific maintains sufficient liquidity, to ensure viable operations can continue past the coronavirus pandemic.

The 6.08% ownership will include 416.6 million shares. Furthermore the government will purchase an additional 195 million preferential shares, worth HK$19.5 billion ($2.5 billion).

Additionally, the Hong Kong Government (via Aviation 2020 Limited) will bridge a HK$7.8 billion ($1.01 billion) loan to the struggling airline.

As part of the required undertakings the Hong Kong Government will appoint two observers, who will attend each board meeting. Whilst these observers will not have direct voting rights, it is yet to be seen what influence they could have over the board’s decisions. However, Swire Pacific will remain the controlling shareholder for Cathay Pacific.

The Recapitalisation Process

Cathay Pacific has not yet detailed the full extent of the recapitalisation, however the airline is promising pay cuts for senior executives.

“In the short term the Board intends to implement a further round of executive pay cuts and a second voluntary special leave scheme for employees and, in the longer term, to re-evaluate all aspects of the Cathay Pacific Group’s business model to meet the air travel needs of Hong Kong, while keeping Cathay Pacific’s financial status at a healthy level and meeting its responsibilities to shareholders.”

Cathay Pacific Board of Directors

The Hong Kong Government will continue to hold its 6% stake until such time when Cathay Pacific can pay back the bridging loan. Furthermore, the loan will come with a 1.5% interest rate per annum.

Any losses in relation to encumbered aircraft will be applied to the bridging loan upfront. A key condition of the loan is that Swire Pacific, Air China and Qatar all retain their shares until such time that the loan is fully paid off.

The government loan will be the first-ever extended to a private corporation, according to sources familiar with SCMP.

Cathay Pacific’s Outlook

In the first four months of 2020, the Cathay Pacific Group (including Cathay Dragon) carried 64.4% less passengers. This is a 49.9% decrease in capacity and a 59.1% decrease in passenger per kilometre revenue, compared to the same period in 2019.

Cathay Pacific has said it plans to increase passenger capacity slightly from 3% in May to 5% in June, subject to Hong Kong health restrictions. The Hong Kong Government announced on 2nd June that the city’s borders will remain closed to foreigners until at least September.

The announcement coincided with Hong Kong International Airport reopening to transit passengers on 1st June. This will allow stranded citizens to return to their home countries in circumstances where they otherwise would not.

Despite remaining optimistic at a long-term recovery and growth; Cathay Pacific’s board has said no clear timeline is available, due to the rapidly changing coronavirus situation.

“This is the biggest challenge to the aviation industry that Cathay Pacific has ever witnessed and, overall, it does not anticipate that there will be a meaningful recovery for an extended period.”

Cathay Pacific Board of Directors

More information will be revealed in the coming weeks. We will continue to post significant updates to SamChui.com

Article Sources: Cathay Pacific/Swire Pacific, via the Hong Kong Stock Exchange. Additional information from SCMP.