Cathay Pacific has issued a profit warning, painting a bleak interim future for the airline. Throughout the first half of 2020, Cathay has incurred a net loss of HK $9.9 billion ($1.28 billion) – representing an 87% increase in net losses, compared to H1 2019.

Adding to the uncertainty for shareholders, the Hong Kong flag-carrier and its regional subsidiary have revealed that, during June, passenger figures dropped 99.1% when compared year-on-year. For cargo, the story is not as bleak, both airlines carried 56.9% of what was carried in June 2019.

Outlook

Speaking about Cathay’s outlook, Chief Customer Officer Ronald Lam said the airline will be cautious in its approach to future operations.

“While some markets are starting to relax border restrictions and quarantine requirements in July, we remain cautious and agile in our approach to resuming our passenger flight services. The one certainty facing the global aviation industry is that the landscape will be significantly changed when international air travel recovers. The Group is moving decisively to best position the business to be competitive and to secure its financial health over the long term in a new normal.”

Ronald Lam, Cathay Pacific Group Chief Customer and Commercial Officer

Cathay Pacific and Cathay Dragon also told SamChui.com that both airlines will operate at a combined 7% capacity throughout July. Additionally, they are gearing up for 10% capacity by August and potentially more significant increases in later months.

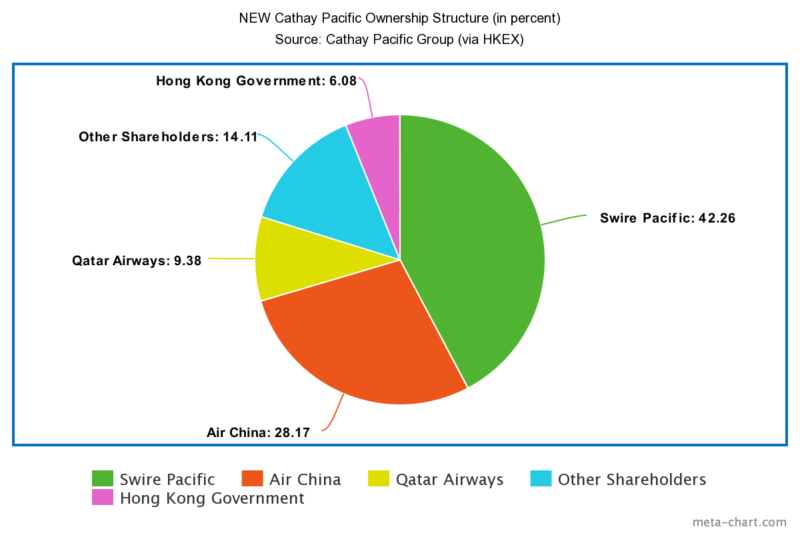

The Hong Kong Government has appointed two observers as part of a bailout package, in which 6% of the airline will belong to the HKSAR. The move comes as part of the flag carrier’s HK$39 billion ($5.03 billion) recapitalisation process.

Profit Warning

Unaudited results from 1st January – 30th June have revealed a net loss HK $9.9 billion ($1.28 billion) attributable to shareholders. Furthermore, Cathay Pacific told shareholders that 16 aircraft that are unlikely to re-enter meaningful economic service again before the 2021 summer season. Sources have told SamChui.com that job cuts are possible in relation to this announcement, although most Cathay employees are covered under Hong Kong Government employment support measures.

“What will not change is our resolute commitment to safety, to serving our customers and our dedication to contributing to the success of the Hong Kong international aviation hub. We remain absolutely confident in the long-term prospects of both the Cathay Pacific Group and our home hub.”

Ronald Lam, Cathay Pacific Group Chief Customer and Commercial Officer

June Traffic Figures (Cathay Pacifc/Cathay Dragon Combined)

| Region | Revenue Passenger Kilometres (000) | % Change vs. June 2019 |

| Mainland China | 3350 | -99.5% |

| North-East Asia | 5791 | -99.6% |

| South-East Asia | 17,796 | -98.8% |

| South Asia, Middle East, Africa | – | -100% |

| South-West Pacific (incl. Australia) | 21,713 | -98.2% |

| North America | 71,010 | -97.9% |

| Europe | 26,053 | -99.1% |

| RPK Total (000) | 145,713 | -98.8% |

| Total Passengers Carried | 27,106 | -99.1% |

| Number of Flights (incl. Cargo) | 1,110 | -83.7% |

“Demand continued to be very weak in June with our airlines carrying less than 1% of the passengers we carried in the same month in 2019. We operated about 4% of our normal passenger flight capacity in June. Load factor remained low at 27.3% and on average we carried approximately 900 passengers a day only.”

Ronald Lam, Cathay Pacific Group Chief Customer and Commercial Officer