The 737 is Boeing’s primary money maker. With 50 years of history and over 14,000 orders since it’s maiden flight in 1967, it’s crucial that Boeing keeps the jet in production at a fast and efficient rate.

For the most part, recent generation 737s have rolled out of the factory smoothly and quickly, with testing and handover times now occurring in multiples per day.

However, recent times have seen Boeing struggle to maintain deliveries at their promised schedule. Around 40 unfinished 737s are currently lined up the Renton factory, some missing engines, some missing interior fittings and some missing wing components. Fuselage pieces that were expected earlier have also not arrived from Boeing’s suppliers on time.

Delays are always prepared for but this sudden change is starting to become a problem for Boeing.

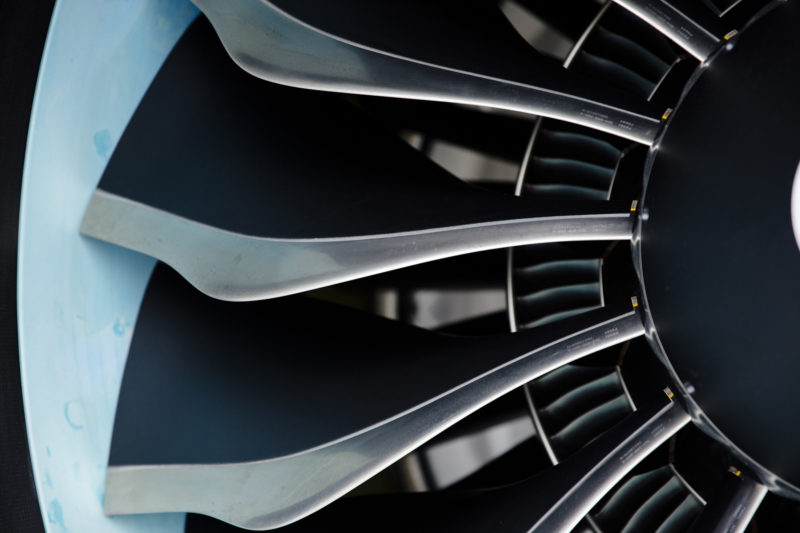

Ever since they announced the increase from 47 to 52 737s per month, suppliers from around the world have struggled to deliver parts on time, whether it be engines, wing components or interior furnishings.

Engines were previously delayed but the addition of new supplier issues means they are more of an issue.

Another contributing factor to these delays is the fact that Boeing is running short of fitters and skilled laborers. To compensate for their recently retired workers, Boeing has reintroduced workers from the KC-46 program back onto the 737, hoping they’ll keep things on track.

Positions for jobs are open and Boeing has been hunting down everyone who is capable of joining the workforce. Social media campaigns, company events, community information sessions are just some of the things Boeing has been aggressively pitching to people in the area.

Despite these issues, Boeing remains firm on the fact that it has not upset any airlines, mainly due to rising fuel prices, forcing airlines to work with the money they have and extend the life of their current fleets. Loyal Boeing customers do hold flexible delivery contracts so the idea of pushing back aircraft is not a bad one.

CFM International recently stated at the Farnborough International Air Show that engine deliveries will be corrected as soon as possible. In the meantime, the company says they’re only a few weeks behind schedule. This applies to Airbus too as their A320neo family has the CFM LEAP engine on offer to customers.

Airbus has already been struck with similar problems in the past, and is now working to fix a ripple effect caused by them. Pratt and Whitney has had ongoing engine issues which delayed deliveries and grounded aircraft, CFM is behind schedule and vendors are feeling the pressure from increased production demand.

While Pratt and Whitney appears to be resuming deliveries with the recently fixed engine components, Airbus is now in full swing to get as many as the aircraft on the backlog delivered.

With both parties proposing an increase in production, it’s important that the smaller suppliers aren’t left out. Without them in high-production mode, problems like this occur. Trade disputes and financial results are also putting additional pressure on everyone to sustain deliveries.