Airbus reports strong Full-Year 2018 results, delivers on guidance

- Strong 2018 performance, guidance delivered

- Revenues € 64 billion; EBIT Adjusted € 5.8 billion; Free Cash Flow Before M&A and Customer Financing € 2.9 billion

- EBIT (reported) € 5.0 billion; EPS (reported) € 3.94

- A380 deliveries to cease in 2021

- A400M programme re-baselining negotiated

- 2018 dividend proposal € 1.65 per share, up 10% from 2017

- 2019 guidance confirms growth trajectory

Amsterdam, 14 February 2019 – Airbus SE reported strong Full-Year (FY) 2018 consolidated financial results and delivered on its guidance for all key performance indicators.

“Though 2018 had plenty of challenges for us, we delivered on our commitments with record profitability thanks to a strong operational performance, particularly in Q4,” said Airbus Chief Executive Officer Tom Enders.

“With an order backlog of around 7,600 aircraft, we intend to ramp-up aircraft production even further. However, due to the lack of airline demand we have to wind down production of the A380. This is largely reflected in the 2018 numbers."

"On A400M, we succeeded in re-baselining the programme with our government customers and their domestic approval processes should conclude in the coming months. All in all, we have achieved significant de-risking of the A400M in 2018. The strength of last year’s achievements is reflected in our record dividend proposal. In sum, Airbus stands on a solid growth trajectory and our helicopter, defence and space businesses are also in good shape as the new management team under my successor Guillaume Faury gets ready to take over.”

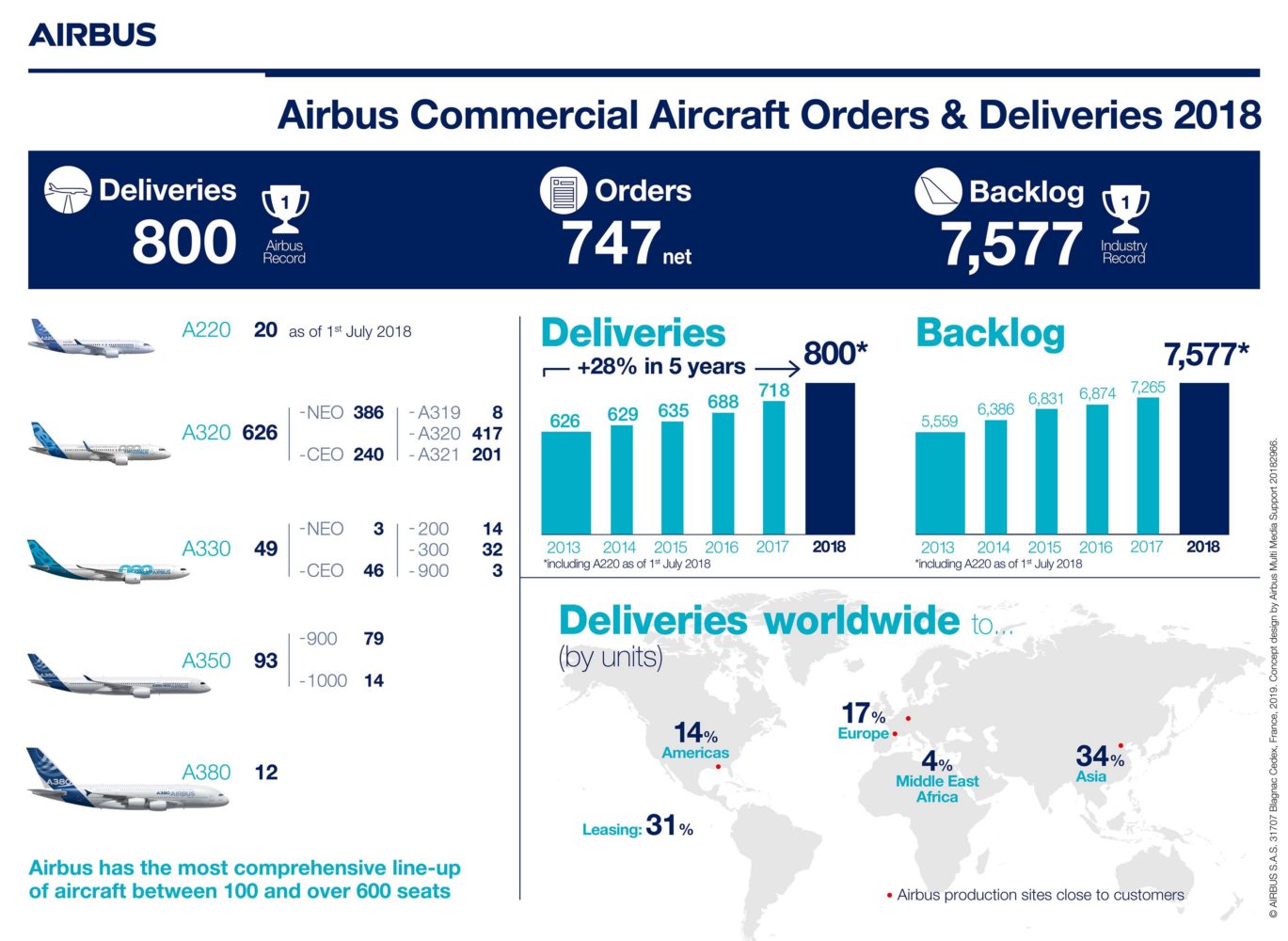

The company successfully met their 2018 delivery goal of 800 aircraft, setting a new company record and keeping them on path for future growth and delivery guidance. Compared to 2017s 718 deliveries, 2018 is an 11% increase, which is a significant amount. This continues Airbus’ 16 year trend of increasing deliveries per year.

Below are the results for the company in a table:

| Aircraft | Deliveries 2018 | Deliveries 2017 |

| A220 | 20 (since July 2018) | — |

| A320 | 626 (386 A320neo Family) | 558 (181 A320neos) |

| A330 | 49 (3 A330-900s) | 67 |

| A350 | 93 | 78 |

| A380 | 12 | 15 |

Airbus saw a reduction in orders in 2018, with net orders totaling 747 compared to 1109 in 2017. A new industry record is stated to be set by Airbus, with 7,577 aircraft in their backlog, of which, 480 are the recently introduced A220s. This is compared to the 7,265 achieved in 2017.

As of 1 July 2018, the A220 aircraft programme has been consolidated into Airbus.

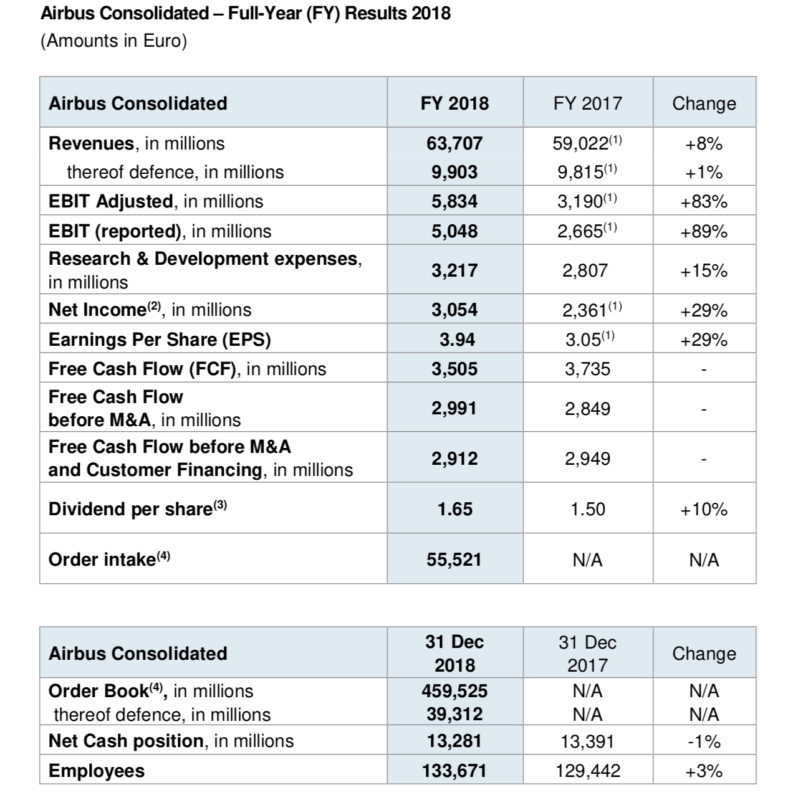

Airbus Consolidated – Full-Year (FY) Results 2018

(Amounts in Euro)

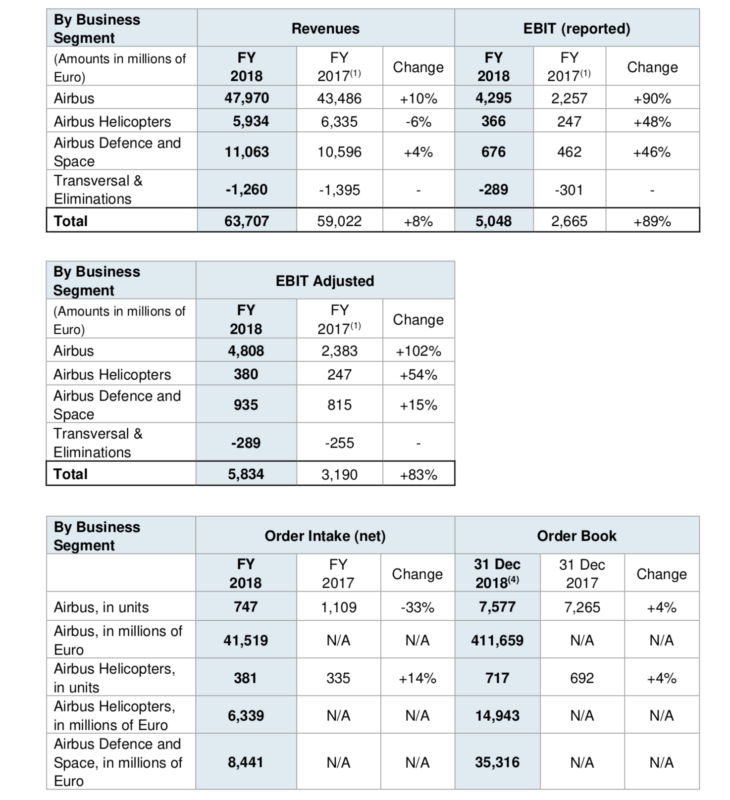

Consolidated revenues increased to € 63.7 billion (2017: € 59.0 billion(1)), mainly reflecting the record commercial aircraft deliveries. At Airbus, a total of 800 commercial aircraft were delivered (2017: 718 aircraft), comprising 20 A220s, 626 A320 Family, 49 A330s, 93 A350s and 12 A380s. Airbus Helicopters delivered 356 units (2017: 409 units) with revenues stable year-on-year on a comparable basis despite the lower deliveries. Higher revenues at Airbus Defence and Space were supported by its Space Systems and Military Aircraft activities.

Following a review of its operations, Emirates is reducing its A380 orderbook by 39 aircraft with 14 A380s remaining in the backlog yet to be delivered to Emirates. As a consequence of this decision and given the lack of order backlog with other airlines, deliveries of the A380 will cease in 2021.The recognition of the onerous contract provision as well as other specific provisions and the remeasurement of the liabilities have led to a negative impact on EBIT of € -463 million and a positive impact on the other financial result of € 177 million.

Airbus Helicopters’ EBIT Adjusted increased to € 380 million (2017: € 247 million(1)), reflecting higher Super Puma Family deliveries, a favourable mix and solid underlying programme execution.

Airbus Defence and Space’s EBIT Adjusted totalled € 935 million (2017: € 815 million(1)), mainly reflecting solid programme execution.

On the A400M programme, 17 aircraft were delivered during the year (2017: 19 aircraft). Airbus continued with development activities toward achieving the revised capability roadmap. Retrofit activities are progressing in line with the customer agreed plan. The customer Nations are now set to pursue their domestic approval processes. An update of the contract estimate at completion triggered a net additional charge of € -436 million on the programme.

Consolidated self-financed R&D expenses totalled € 3,217 million (2017: € 2,807 million).

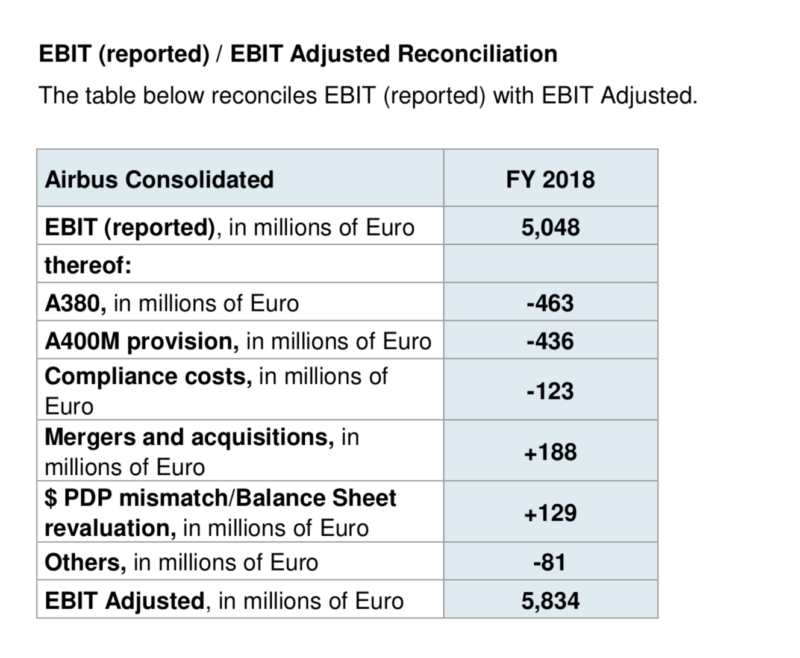

EBIT (reported) / EBIT Adjusted Reconciliation

The table below reconciles EBIT (reported) with EBIT Adjusted.

- The net negative impact of € -463 million related to the A380 programme;

- The net additional charge of € -436 million for the A400M programme;

- A negative € -123 million related to compliance costs;

- A positive € 188 million related to Mergers and Acquisitions, including the sale of Airbus DS Communications, Inc. business in the first quarter;

- A positive € 129 million relating to the dollar pre-delivery payment mismatch and balance sheet revaluation;

- A negative € -81 million related to other costs.

You can download the Airbus full year financial result here.

Just like Boeing, Airbus has had a great year, and with 2019 slowing down for new aircraft developments, the next big focus for the company is refining their industrial and management processes.

For a full breakdown, see the infographic below:

You can download the Airbus full year financial result here.

You can download the Airbus full year financial result here.

Footnotes

1) Where applicable, 2017 figures have been restated to reflect the adoption of the IFRS 15 accounting standard and new segment reporting as of 1 January, 2018. The new segment reporting reflects the merger of Headquarters into Airbus. Where applicable, ‘Airbus’ refers to commercial aircraft and the integrated functions while ‘Airbus Consolidated’ or ‘the Company’ refers to Airbus SE.