The coronavirus has handed airlines their biggest crisis since the Sept 11th 2001 terrorist attacks.

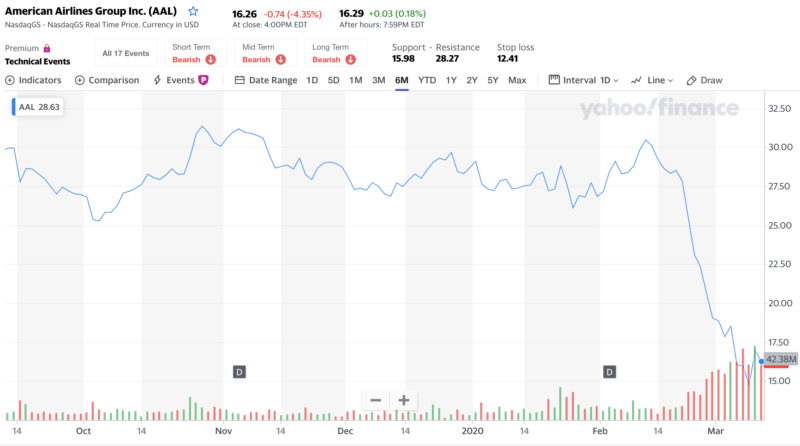

Fears about the coronavirus epidemic have disproportionately hurt the travel industry, with airlines announcing a drastic fall in bookings. According to CCN, American Airlines, with its high debt, now faces the prospect of filing for bankruptcy. American Airlines (AAL) has lost more than 50% of their value, since their 2020 high.

In 2011, a highly leveraged American Airlines filed for Chapter 11 bankruptcy protection. Many of the issues that were present in 2011 – high debt and ongoing labour disputes are still impacting the airline today.

American is now more leveraged than nine years ago. When filing for bankruptcy in 2011, American Airlines reported liabilities of $29.55 billion. This time round, American has more than $34 billion in debt.

This contrasts sharply with the $20 billion held by United Airlines Holdings Inc, $17.4 billion by Delta Air Lines Inc and $4.6 billion held by Southwest Airlines Co.

According to CCN, AAL bonds are near distressed levels. This elevates bond investors’ worries over the carrier’s ability to repay debt. Last week some of the firm’s bonds were yielding over 12%. At time of low or negative interest rates, a double-digit yield suggests high levels of default.

Instead buying down the debt, American Airlines authorised $2 Billion in stock buybacks to be completed by December 31st 2020.

Airlines Biggest Crisis Since Sept 11

United Airlines on Tuesday reported a 70% drop in domestic demand in the last few days. They have said that they will have to make more deep cuts to flights in the coming months, as the coronavirus keeps travellers at home.

United’s net bookings, which include new reservations minus cancellations, have collapsed in Asia and Europe, said Scott Kirby, the airline’s president who is scheduled to take over as CEO from Oscar Munoz in May. While domestic net bookings are down 70%, gross bookings are down 25%; which Kirby said is a better measure of current demand.

Global airlines stand to lose up to $113 billion in sales due to the coronavirus, the International Air Transport Association estimated in early March, up from the $30 billion loss the trade group had forecast just two weeks earlier.

As COVID-19 sinks demand, crude oil prices have tanked; offering some relief on costs, as fuel is the most expensive input for airlines.

H/T CCN