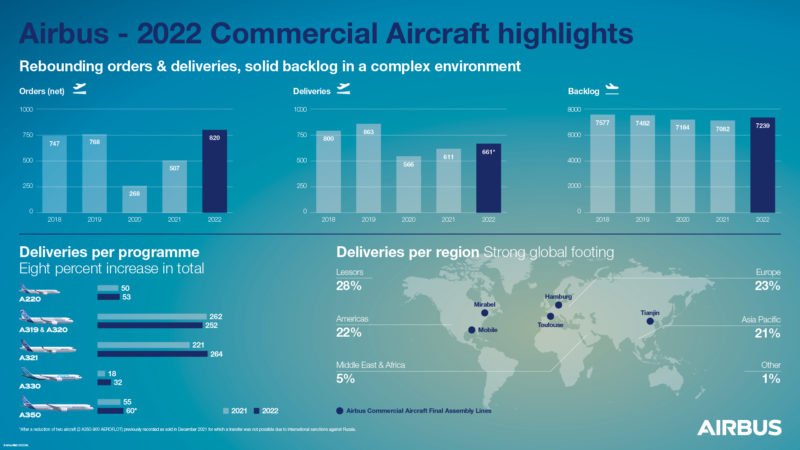

Airbus 2022 Order and Deliveries

Airbus SE delivered 661* commercial aircraft to 84 customers in 2022 and registered 1,078 gross new orders.

Airbus’ end December 2022 backlog stood at 7,239 aircraft.

“In 2022 we served 84 customers with 661 deliveries, an increase of 8 percent compared to 2021. That’s obviously less than we were targeting but given the complexity of the operating environment I want to thank the teams and our partners for the hard work and the ultimate result,” said Guillaume Faury, Airbus Chief Executive Officer. “The significant order intake covering all our aircraft families including freighters, reflects the strength and competitiveness of our product line. We continue our ramp-up trajectory to deliver on our backlog.”

In 2022, deliveries included:

| 2022 | 2021 | |

| A220 Family | 53 | 50 |

| A320 Family | 516 | 483 |

| A330 Family | 32 | 18 |

| A350 Family | 60* | 55 |

| A380 | - | 5 |

| Total | 661* | 611 |

* After a reduction of two aircraft (2 A350-900 AEROFLOT) previously recorded as sold in December 2021 for which a transfer was not possible due to international sanctions against Russia.

Airbus won 1,078 new orders (820 net). Per programme, the A220 won 127 firm gross new orders. The A320neo Family won 888 gross new orders. In the widebody segment, Airbus won 63 gross new orders including 19 A330s and 44 A350s of which 24 were for the newly launched A350F.

Boeing 2022 Order and Deliveries

Boeing reported 774 commercial orders last year after cancellations and conversions, including 561 orders for the 737 family and 213 orders for the company's market-leading twin-aisle airplanes. Boeing delivered 69 commercial jets in December, including 53 737 MAX, bringing total deliveries for 2022 to 480 airplanes.

"We worked hard in 2022 to stabilize 737 production, resume 787 deliveries, launch the 777-8 Freighter and, most importantly, meet our customer commitments," said Boeing Commercial Airplanes President and CEO Stan Deal. "As the airline industry expands its recovery, we are seeing strong demand across our product family, particularly the highly efficient 737 MAX and the 787 Dreamliner. We will stay focused on driving stability within our operations and the supply chain as we work to deliver for our customers in 2023 and beyond."

Commercial orders after cancellations and conversions include:

- 561 orders for the 737 MAX, adding new customers such as ANA, Delta Air Lines, IAG, and low-cost carrier Arajet

- 213 orders for widebodies, including 114 787s, 31 767s and 68 777s

- 78 orders across Boeing's freighter line, including 45 orders for the 767-300 Freighter and current 777 Freighter

- Launching the 777-8 Freighter with more than 50 orders, including conversions, for the market's most capable freighter

Commercial deliveries include:

- 387 737s, including 374 737 MAX and 13 military-derivative airplanes

- 93 widebodies, including 5 747s, 33 767s, 24 777s and 31 787s

- 44 new production freighters

As of Dec. 31, 2022, the Commercial Airplanes backlog is 4,578 jets.

Airbus vs Boeing in 2022

Airbus has clearly won more narrowbody orders. The A220 won 127 firm gross new orders. The A320neo family won 888 gross new orders while Boeing landed just 561 B737 MAX orders.

However, Boeing has won much bigger wide-body orders including 213 widebodies (including 114 787s, 31 767s and 68 777s) + 78 widebody 767 and 777 Freighters and 50 newly launched B777-8F. This includes the historic order of 100 B787 from United Airlines.

In the widebody segment, Airbus won just 63 gross new orders including 19 A330s and 20 A350s plus 24 the newly launched A350F. Airbus suffered several big order cancellations, including 63 mid-size A330neos by AirAsiaX and 19 large A350s in a dispute with Qatar Airways.