In 2024, while some airlines capitalized on surging international demand and flexible network strategies to post impressive earnings, others struggled with rising fuel costs, labor shortages, and structural inefficiencies.

In this article, we cover the most profitable and least profitable airlines based on net profit or loss, alongside the top 10 airlines by revenue.

Most Profitable Airlines in 2024

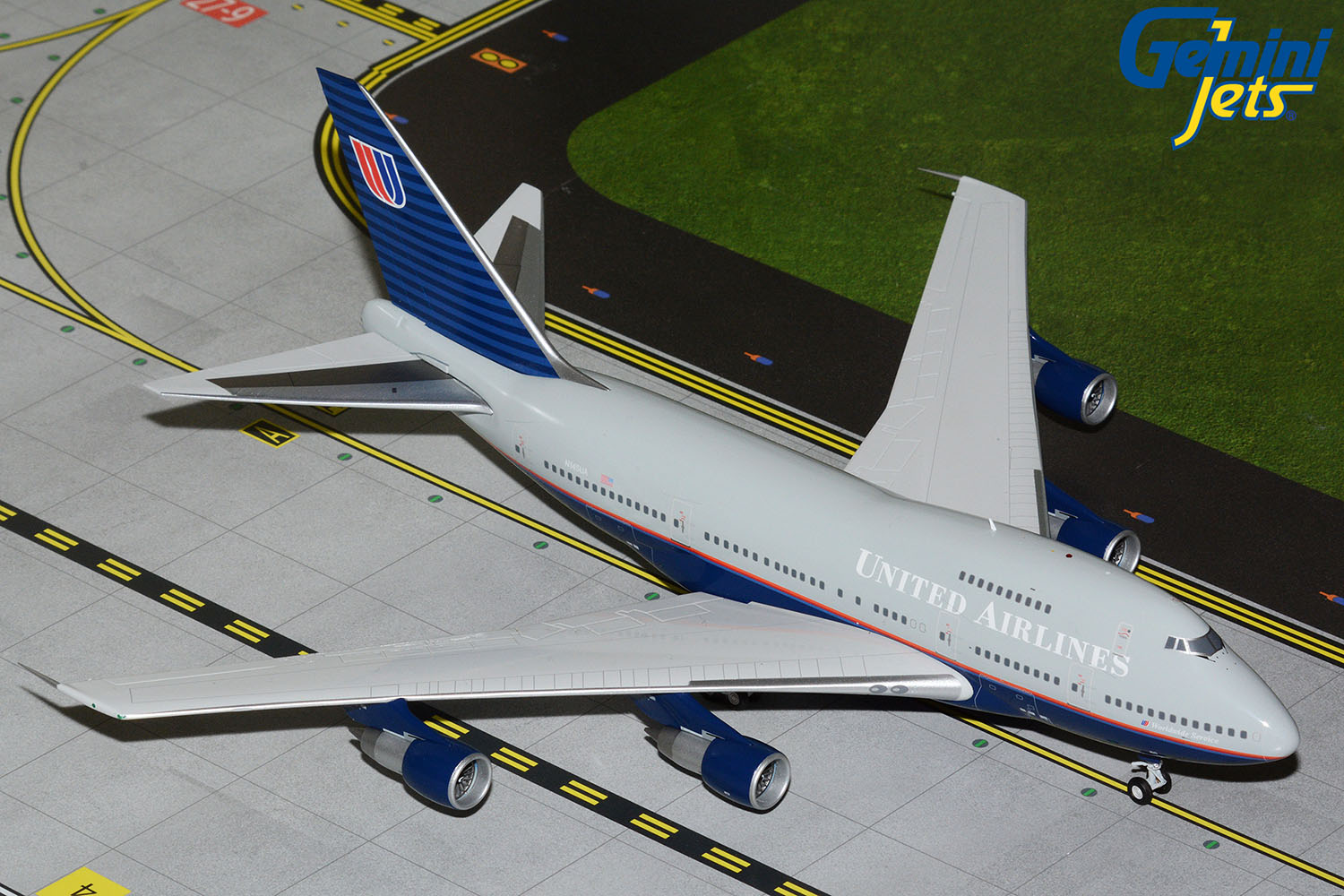

In 2024, legacy carriers and highly diversified airline groups dominated the profitability leaderboard. Emirates topped the list with an industry-leading net profit of $4.7 billion, powered by strong demand across premium cabins, long-haul travel, and a sharp rebound in Asia-bound traffic. Delta Air Lines ranked second with a net profit of $3.46 billion, followed closely by United Airlines with $3.15 billion in net income.

Moreover, the European airline group IAG – parent of British Airways and Iberia secured the fourth spot with a $3 billion net profit, capitalizing on its strong transcontinental networks and recovering long-haul demand.

Singapore Airlines also enjoyed a strong year leading the Asia-Pacific region, generating $2.05 billion in net profit, boosted mainly by long-haul travel demand and cargo operations.

Rounding out the top ten were Air France-KLM, Qatar Airways, and Lufthansa, each benefitting from a mix of international recovery and cost efficiencies.

| Rank | Airlines | Net Profit (USD) |

|---|---|---|

| 1 | Emirates | $4.7 Billion* |

| 2 | Delta Air Lines | $3.46 Billion |

| 3 | United Airlines | $3.15 Billion |

| 4 | IAG | $3 Billion |

| 5 | Turkish Airlines | $2.4 Billion |

| 6 | Ryanair | $2.07 Billion |

| 7 | Singapore Airlines | $2.05 Billion |

| 8 | Air France-KLM | $1.73 Billion |

| 9 | Qatar Airways | $1.7 Billion* |

| 10 | Lufthansa | $1.51 Billion |

*Note: Emirates and Qatar Airways operate on a fiscal year cycle (April 2023 – March 2024), unlike most other airlines that report based on the calendar year.

Least Profitable Airlines in 2024

On the other end of the financial spectrum, several airlines found themselves in deep financial turbulence. Brazilian carrier Azul recorded the largest net loss, totaling $1.6 billion, as it struggled with currency volatility and high debt burdens. Spirit Airlines, facing intense cost pressures and strategic uncertainty after its blocked merger with JetBlue, posted a loss of $1.2 billion.

Moreover, JetBlue itself reported a significant net loss of -$795 million, impacted by rising costs, inconsistent demand, and network challenges.

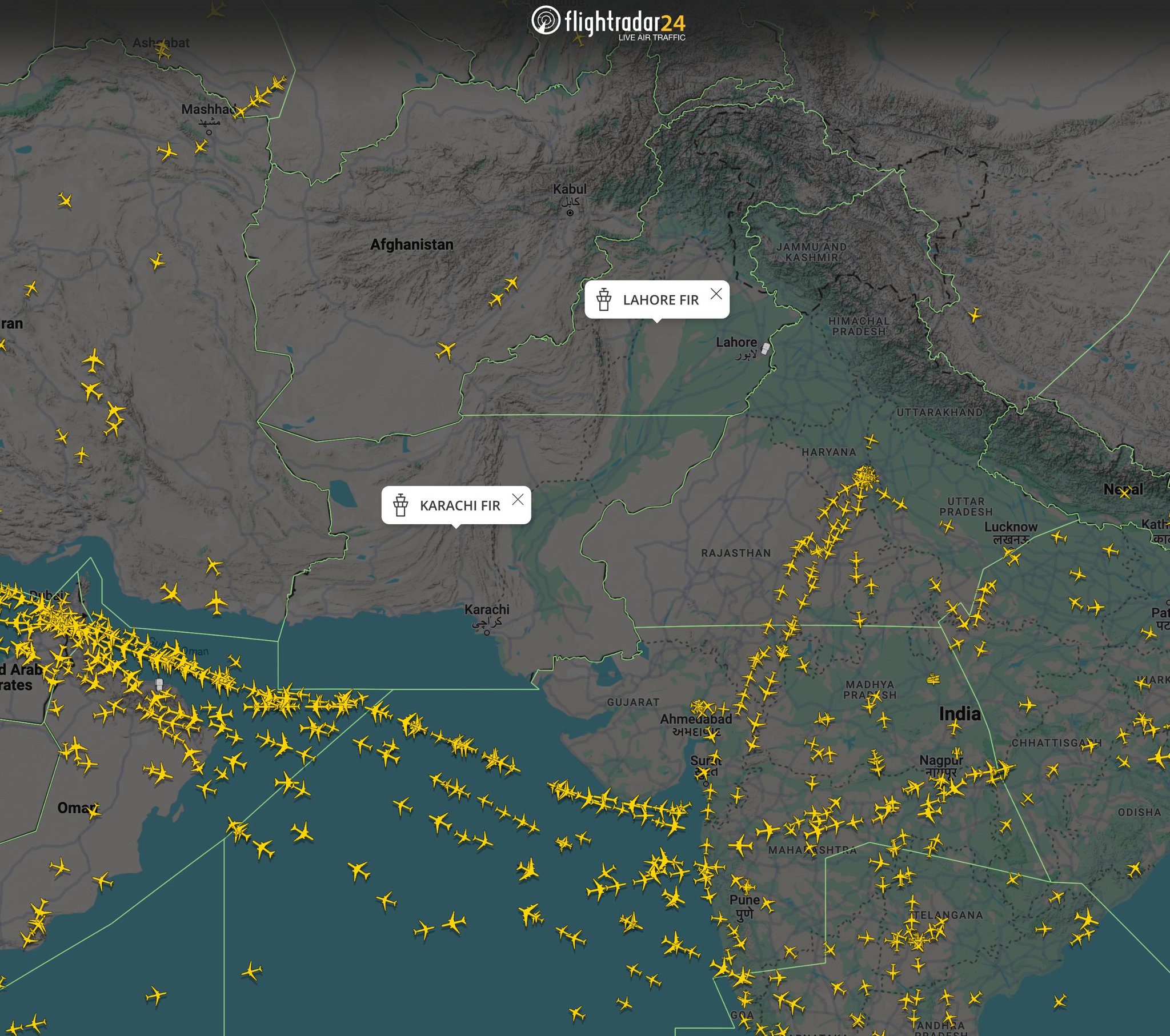

Besides the U.S., Chinese carriers led by China Eastern Airlines were dragged down by sluggish market recoveries and structural inefficiencies. The Chinese carriers are still grappling with uneven international recovery and domestic competition.

Asiana Airlines also remained deep in the red as it approached the final stages of its merger with Korean Air.

| Rank | Airlines | Net Loss (USD) |

|---|---|---|

| 1 | Azul | -$1.6 Billion |

| 2 | Spirit Airlines | -$1.2 Billion |

| 3 | JetBlue Airways | -$795 Million |

| 4 | China Eastern | -$578.37 Million |

| 5 | Asiana Airlines | -$329.5Million |

| 6 | China Southern | -$243.77 Million |

| 7 | Allegiant Air | -$216.2 Million |

| 8 | Norse Atlantic Airways | -$154 Million |

| 9 | Air Transat | -$114 Million |

| 10 | Garuda Indonesia | -$62.9 Million |

Top 10 Airlines by Revenue in 2024

Unsurprisingly, U.S. carriers once again dominated the global revenue leaderboard, with Delta Air Lines leading the way at $61.64 billion. United Airlines and American Airlines followed closely, each surpassing $50 billion in annual revenue.

European legacy groups like Lufthansa, IAG, and Air France-KLM filled out the middle tier of the top 10 airlines, each generating between $33 billion and $40 billion. These groups benefited from resurgent transatlantic demand and strong performance from subsidiary carriers such as Iberia, KLM, and SWISS.

Meanwhile, Emirates’ revenue for the fiscal year increased by 13% to $33 billion, whereas low-cost giant Southwest Airlines cracked the top 10 with nearly $27.5 billion in revenue. Among the top 10 are two Chinese carriers – China Southern and Air China.

| Rank | Airlines | Revenue |

|---|---|---|

| 1 | Delta Air Lines | $61.64 Billion |

| 2 | United Airlines | $57.06 Billion |

| 3 | American Airlines | $54.21 Billion |

| 4 | Lufthansa | $40.53 Billion |

| 5 | IAG | $34.62 Billion |

| 6 | Air France-KLM | $33.93 Billion |

| 7 | Emirates | $33 Billion |

| 8 | Southwest Airlines | $27.48 Billion |

| 9 | China Southern Airlines | $24.24 Billion |

| 10 | Air China | $23.19 Billion |

Sources: Airlines Newsroom, Companies Market Cap

I’m sure you have heard this a trillion times, but do you need a travel buddy? Haha

If Emirates is making a net profit of 4,7 billion, how much is that profit per passenger ? So draft an extra column with profit per passenger for those 10 airlines….

You are messing with statistics. Per unit of revenue I believe that you will find Ryanair to be the most profitable carrier….

We publish statistics from sources indicated.

In FY 2024 Garuda Indonesia lost USD$69 million; so it should be on your list!

Thanks for highlighting. I’ve updated the article accordingly. Just a quick clarification: Garuda Indonesia reported a net loss of USD $62.9 million for FY 2024.